What is PMEGP (Pradhan Mantri Employment Generation Programme):

Friends, if you need money and want to take a loan. You have visited banks many times, visited many places but you are not getting the loan. But if you want to take a loan then brother, I say that you should stop wandering here and there. Rather, you can take money from here under the government scheme which is being run by the Prime Minister and known as PMEGP (Pradhan Mantri Employment Generation Programme). That means you can take a loan and I will tell you the biggest benefit of the loan because I am my own. Applied for loan of ₹ 6 lakh here. If I myself showed you ₹ 6 lakh, then here you can see that only subsidy of ₹ 1.5 lakh is being received. Subsidy of Rs 1.5 lakh is being provided.

Friends, I am getting full 15 years time to pay the amount here and the rate of interest here is very low, only nine percent. How to take this loan, how can you take it, what will be the process?

I am going to share complete information with you in this video. Read this article completely and without skipping. Only then you will understand which thing needs to be filled up where. Otherwise, if you make a small mistake anywhere, your loan will get stuck. Five, 10 and 15 minutes time has to be given. You will get its complete information here.

How to apply online for PMEGP scheme:

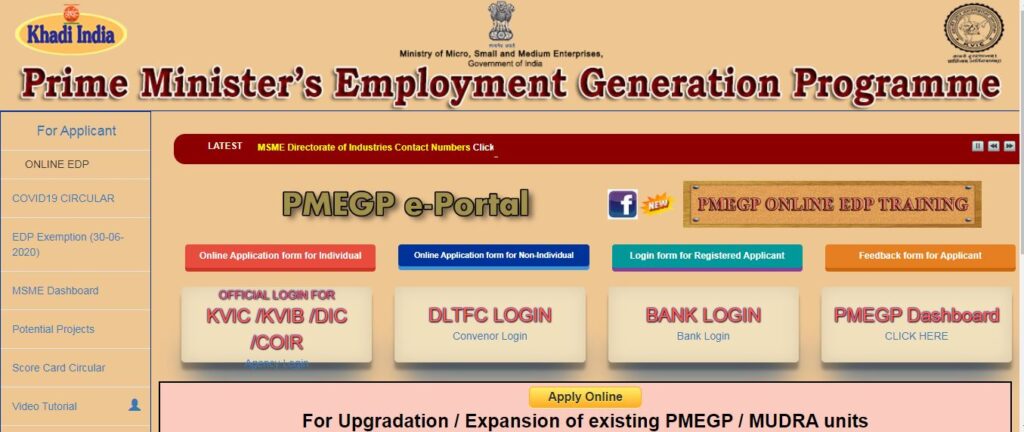

Friends, to apply for the loan, you have to go to Google Chrome. After coming here, you will search for public support, the first website you will find is the government website kviconline, you will click on it for PMEGP login portal. As soon as you visit this page, you will see that an alert has been given. Understand that alert very carefully.

The important thing is that whenever you apply for loan from anywhere, many times you start getting spam calls etc. Money is demanded from you. If you pay your processing fee and GST, you will get your loan. Mentioned for here. It is being said that you will get the recording of this loan through this website, you will not get any call, message etc. and you do not need to pay any money in advance to take this loan. Is. You have to keep this in mind, otherwise you might be involved in a fraud.

Type of loan:

So friends, you can see the government website and the loans mentioned here in Blue are five categories of loans which is PMEGP scheam list. Which category? Let us look at it carefully. The first loan would be your education loan. That means, if you want to take a loan for your education or for completing your graduation, then you can take a loan from here. The second one is Agri Loan, which is a loan against Kisan Credit Card. If you want to take it, you can take it from here. The third loan can also be seen here. We will see the Agri Infrastructure Loan for farmers and the fourth loan. Business activity is loan i.e. want to expand your business.

If you want to start a business, you will get it here and the fifth loan is home loan, you can easily take it here. So finally friends, you will see that not just one but five types of loans are available here which can fulfill all your needs. At present, the name of the loan that we are going to apply here is going to be Business Loan. Because this is the need of most of the people, if they want to start their own business or if they have already started their business, then it can be expanded further by taking a loan. So how much loan will you get here, how much interest will be charged?

Business Loan for new business:

What kind of application? Let me share complete information with you. Friends, before applying for business loan, we will check your eligibility for. I would like to clear you beforehand and leave later. What is coming in your mind, if I want to take an education loan or any other loan, then how will we apply for it?

So I would like to tell those five people. The process of applying for the loan is exactly the same. The only thing that will remain is that your loan category will be different. Okay, so friends, the first thing that is asked here is to decide whether the loan is being given to you. You might have seen five loan categories but there are 12 schemes, so it is decided which scheme you will get to see.

Fill the PMEGP Application:

So first of all it is asked whether you want to do some work other than handloom work here or do you want to take it here for annual venture. The third one is the street vendor. That is, if you want to do street work etc. for that or you feel that the things that you want to do are not shown in it, then there is no problem. Sample sir here. The fourth one is Other Business Loan Sample, sir, click on it.

So friends, like we click on Other Business Loan here. After this you will just see. It is written here that select type business activity.

You want to take a loan for your business. You are about to start a new business or you are already running a business and want to expand that business further. If you want to take money from here to expand, then right now we will click on New here to start our new business. Then after this it is asked whether you have passed eighth class? If yes then click on yes otherwise click on nine. When you are asked whether you have taken EDP training? If you have taken it then it is okay, if you have not taken it. Click on the sample, no problem.

Type of Business or Services:

After this it is asked that select the nature of your business, what is the business going to be like. Be it someone making something or manufacturing it or your business i.e. someone has become a business. Called from service. Providing service. My job is only to provide service. The third is that trading means if the goods are given to you from here to there then you are trading. So brother, which of these three is with you?

Brother, currently our business is going to be service based. We selected it as per our choice. Okay, it has asked to select your gender. If you are male or female then mail here. Mail selected. After this, friends, it is asked here to select your social category i.e. in which category you fall. As you know. Come in. Come in OBC. Whichever comes. You will select it here. At present I come here in General.

PMEGP Application Quota Select:

I have selected General. After this he was asked whether you are an ex-serviceman here or have a physical handicap. If you are then click on Yes here otherwise click on nine from the sample.

After this, friends, here you will see that the names of some states have been shown to you. Do you come from that state? If it comes then click on yes otherwise click on nine. The names of all the states are already mentioned here, which you will see here. Okay, so at the moment I am not from this state, so I click on the symbol time here.

I would like to tell you that my hometown is from UP. If you comment on UP Police, if you like from Haryana and just after this it was asked here, select your location, whether the location where you are living is your city or a rural area, then you can select it with your coding. i.e. urban or ruler. Still friends, I am here

PMEGP online option Urban or Rural:

I would like to clarify that the word ‘Urban’ written in English means that you live in a city and the word ‘Ruler’ means that you live in a rural area. Currently, I type urban here because I live on the city side. Right after this, you are again asked the specific type of application beneficiary i.e. the business loan for which you apply is going to be individual.

That is, if you are doing it yourself or with your group or in partnership, then here I select it as Individual. And after this the most important thing which you have to keep in mind here. Because when it comes to money for which you have applied for this loan, look at the points very carefully and do not do it at all.

So here also it is being asked that you are the one who will start the work as written here. If interest method project cost is written here then it would mean that the work you want to do, like I want to start my own business.

PMEGP Application-Example of Loan Working:

I think it will cost me Rs 6 lakh in total. ₹6 lakh is fine, I will put ₹6 lakh on you. Okay, check your calculations. Enter here as per your requirement. Here I increased it to ₹6 lakh. Exactly 6 lakhs I put here. Now it is asked the difference in the amount you invest in your plant at its source. Meaning, how much money do you have with you?

To Star your new business, You must have some money initially. It is not at all the case that all this is dependent on the government and only on the trust of God. Brother, I have ₹2 lakh. Then the idea came to my mind that I would take a loan and start my work. Okay that’s why I’m asking you to explain.

So right now I have made my deposit of ₹ 2 lakh here, I have ₹ 2 lakh, I have made my deposit of ₹ 2 lakh here. Now here we will talk about the requirement loan amount. Meaning now look my total business is Rs 6 lakhs. If I have ₹4 lakh or ₹2 lakh then take ₹4 lakh from my government. I got absolutely clear.

In this way you can see your account and how much money you have. How much money do you need, everything will be calculated here. Right now we have to click on Calculate Eligibility here, we clicked on it.

PMEGP Eligibility:

So friends, here you will see that it is written that you are eligible for business activity loan listed below i.e. the loan you are applying for. For this, two categories are being shown here or you can say two schemes are being shown. You can choose any one of those two schemes. But first we had to decide which of the two was better for us. So the first thing that you see here is the name of that scheme. Prime Minister Employment Generation Program i.e. PMEGP came. If you want know more about business loan click here.

Subsidy on PMEGP scheme:

You will see that our loan amount is ₹ 4 lakh. The eligible subsidy amount mentioned here is ₹1,50,000. Subsidy is being given here. The best thing from the government is that a rebate of ₹ 1,00,050 is being given here.

The monthly EMI that will come will be only ₹ 4,060, which will be your rate of interest as per nine percent only and the time that is being given is up to 15 years. That means 15 years is a lot of your time. In OK report. But we think once we see the second scheme here. Am I better than him? Can be seen there. So friends, let us scroll down here, our second scheme is Pradhan Mantri Mudra Yojana i.e. PMAY. And you will see that your loan amount is ₹ 4 lakh.

Here the monthly MI will be ₹ 8,000 and ₹ 500 and here also the rate of interest increases slightly. That means you will be charged a rate of interest of 10 percent and here the tuner will give you less time. It’s been five years so yours is increasing.

So friends, after looking at all these, I think that the first scheme is going to be better for you because here you get subsidy of ₹ 1,00,050 and the rate of interest is also less than there and all three times. This means you get plenty of time to make the repayment.

Thanks designed for sharing such a pleasant idea, post is pleasant, thats why i have read it completely